Treating prepaid expenses as assets allows for a more accurate financial representation of a company’s position. The matching principle is upheld by spreading the expense throughout the benefit period, rather than recognizing it all at once. This ensures that expenses are aligned with the revenue generated from the related asset, resulting in more accurate financial statements. After understanding the key definitions and different types of prepaid expenses, now it is time to know how to account for the prepaid expenses as well as how to record the amortization.

Why Is the Difference Between Deferred Expenses and Prepaid Expenses Important?

Amortization of prepaid expenses is a process by which businesses allocate the cost of a prepaid expense over its useful life. Adjusted operating income, adjusted operating margin and adjusted diluted earnings per share are not U.S. Please refer to the “Non-GAAP Financial Measures” section on page 4 of this press release for a discussion of non-GAAP measures. Adjusted operating income, adjusted operating margin, adjusted operating margin and adjusted diluted earnings per share are not U.S. Our effective income tax rate was 22.8% for the fourth quarter and 24.4% for the prior year period. The current year fourth quarter was impacted by the recognition of net discrete tax benefits related to employee stock-based compensation payments.

Lease Commencement Date and Start Date for US GAAP Accounting Explained

Because your new landlord allowed you to move in early, he’s now requesting you pay rent for the entire year, in advance. LeaseCrunch has a team full of CPAs, former FASB staff, and Big Four public accounting auditors ready to answer your toughest lease accounting questions. Prepaid expenses and how they affect a lease depends more on https://www.bookstime.com/ how a lease is written than whether or not it is a commercial lease or has a lease incentive as a part of the contract. Prepaying expenses in foreign currencies exposes the company to currency exchange rate fluctuations. Failure to accurately record and report them can result in financial inaccuracies and potential compliance issues.

- Understanding the difference between deferred expenses and prepaid expenses is necessary to report and account for costs in the most accurate way.

- For intangible assets, the recognition of expense is called amortization, not depreciation.

- Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use.

- Amortization of prepaid expenses is an accounting process that involves recognizing the expense of an asset that was paid for in advance over the specific period of time during which it is used or consumed.

- The company promises to turn any ordinary lemonade stand into a thriving, efficient, and fun business operation by helping her track inventory, forecast revenue based on weather patterns, and launch a loyalty program.

- If you purchase insurance coverage for one year and pay upfront, you should divide the total cost by 12 months and record it as an expense on your monthly financial statements.

- Accounting for amortized prepaid expenses helps businesses stay organized and gives them an accurate view of their finances in the future.

Enter the monthly expense for each accounting period

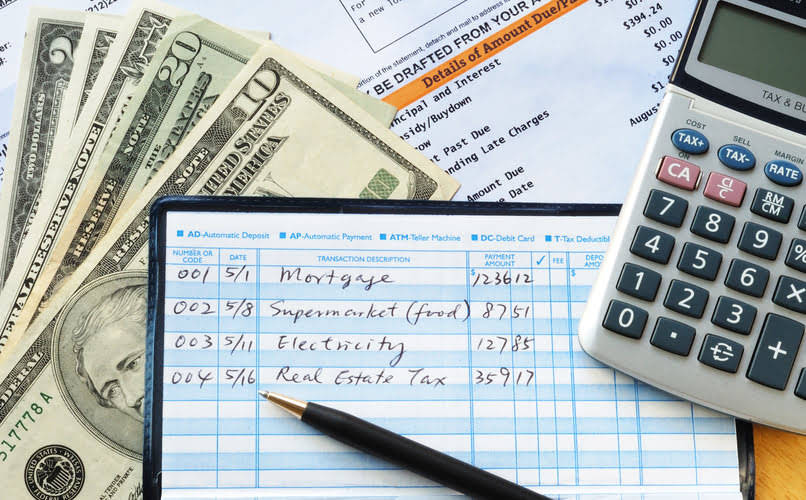

You may want to set up an amortization table to track the decrease in the account over the policy term and to determine what the journal entries will be. Leases can be a great example of situations where a contract may require a lessee to pay a portion of their obligation prior to or at lease commencement. These types of stipulations are generally observed in real estate leases where the landlord typically requires one or two months of the monthly rent obligation upon execution of the contract or at lease commencement. Note that this situation is different from a security deposit which is generally refundable. When we have such schedule, each month we can record the amortization expenses in one transaction together.

Accounting Entries for Prepaid Expenses and Subsequent Amortization

If you’re not an experienced accountant, managing prepaid expenses may seem complicated, but it’s simply a matter of recording the cost as an asset and then taking an expense each month to use up part of that asset. Thus, prepaid expenses aren’t recognized on the income statement when paid because they have yet to be incurred. For example, if you have a debt obligation, such as a loan, and you owe $1,000 next month but decide to pay that amount this month, that is a prepayment. A prepaid expense on the other hand is any good or service that you’ve paid for but have not used yet. This ensures accurate financial analysis, informed decision-making, and effective management of prepaid expenses.

Deferred Expenses

When an entity wants to advertise its products or services, that entity would need to pay the advertising agency or TV channel so that they can advertise for that entity. Throughout this blog, you’ve learned how to effectively manage prepaid expenses, from the initial recording to the accounting methods. By documenting them correctly in your balance sheets, you’re ensuring transparency and compliance with accounting standards. A business may pay for six months or a year of coverage in advance to receive a discount on the premium. In this blog post, we’ll discuss how amortization works, why businesses need to account for the amortization of prepaid expenses, and some tips for accounting for amortization accurately. Recurring expenses such as insurance and rent can be paid for with one payment that covers the cost of the expense for several months or even a year.

- It will clear itself out when the lease payment is posted in the next few days, so there’s no need to change your accounting practices to accommodate it.

- Understanding and appropriately accounting for them is crucial for maintaining sound financial records in a business.

- In some instances, a prepaid expense is not applied equally because the benefit is not the same for each accounting period.

- However, these expenses have a debit balance which keeps reducing as the asset gets utilised over the financial year.

Order To Cash

- The matching principle is upheld by spreading the expense throughout the benefit period, rather than recognizing it all at once.

- Under pressure to close the books, overworked staff may forget to record a charge one month or enter an expense that has been fully amortized.

- The company will receive the benefit of the software for the entire year, but the cost of the subscription must be spread out over the 12 months of the year.

- These entries recognize the expenses related to previously recorded prepaid, ensuring that expenses are recognized in the period they are incurred.

- For example, if you believe fuel prices will go up next month, you may want to prepay for fuel to avoid paying extra when the price rises.